marin county property tax due dates 2021

Taxpayers are being asked to pay online by phone or by mail. The first installment is due November 1 and must be paid on or before December 10 to avoid penalty.

Marin County California And Marin Cities Information Mission Pacific Mortgage

San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

. 1st Installment of Property Taxes Delinquent after December 10th. Property Tax Rate Books. The second installment must be paid by April 10 2021.

County of Marin home page. Both installments may be paid with the first installment. Property tax due dates are not expected to change as a result of the coronavirus pandemic.

Indiana is ranked 890th of the 3143 counties in the United States in order of the median amount of property taxes collected. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Monday April 12 a date not expected to change due to the COVID-19 pandemic.

Revised tax bills may have different due dates so. The second installment must be paid by April 10 2021. The median property tax in Marion County Indiana is 1408 per year for a home worth the median value of 122200.

First Installment of Property Taxes Due Monday 121216. Local property tax revenues are needed now more than ever. 1 and must be paid on or before Dec.

September 28 2021 at 411 pm. Business Property Statement. The assets must be reported at full acquisition cost this includes purchase.

The Tax Collector is located at 3501 Civic Center Drive Room 202 in San Rafael. Once completed return the form by May 31 2021 to. September 27 2021 at 642 pm.

Property Taxes Due by December 10. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

All secured personal property taxes. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. If you qualify please complete and sign the Declaration of Exemption to City of Mill Valley 2021-22 Library Tax Form on the reverse side of this page.

Marion County collects on average 115 of a propertys assessed fair market value as property tax. Online or phone payments recommended by Marin County Tax Collector. Send the correct installment payment stub 1st or 2nd when paying your bill.

The first installment is due Nov. This application serves to request Measure A - County Library Special Tax Senior Exemption Senior Exemption Measure A - To qualify for a 5756 County Library Special Tax Senior Exemption for a single family residence you must be 65 years of age or older by December 31 of the tax year 2021 own and occupy your residence located in the Measure A tax zone of the. This coming Monday December 12 is the last day to pay the first installment of Marin County property taxes.

Tax Rate Book 2021-2022. If you have questions about the following information please contact the Property Tax Division at 415 473-6168. If you have questions about the following information please contact the Property Tax Division at 415 473-6168.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. Both installments may be paid with the first installment. Local property tax revenues are needed more than ever to address the.

10 to avoid penalty. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. Duplicate bills are available on request.

A form will automatically be sent to those who filed the previous year. Online or phone payments recommended by Tax Collector. San Rafael CA The Marin County Tax Collectors Office is reminding property owners that the first installment of property taxes for 2020-21 is due no later than December 10.

Property tax due dates are not expected to change as a result of the COVID-19 pandemic. 10 to avoid penalty. You must file your request by May 31 2021.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. Penalties apply if the installments are not paid by December 10 or April 10 respectively. Reply 1 The first installment of property taxes is due Nov.

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 1. Marin County collects on average 063 of a propertys assessed fair market value as property tax. Marin county property tax due dates 2021 Monday April 4 2022 Edit The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over.

Marin County taxpayers are being asked to pay online by phone or by mail rather than in-person. A Business Property Statement is a form for reporting both real and personal property that is owned controlled managed possessed claimed or utilized for business purposes. Pay Property Taxes by April 12.

The normal office hours are 9am to 430 pm weekdays. 21 rows First installment secured real property taxes due. See detailed property tax information from the sample report for 123 Park St Marin County CA.

San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm. County of Marin MARIN COUNTY CA Marin Countys 2020-21 property tax. 1 and must be paid on or before Dec.

Property must be declared as an asset if it exists on the Lien Date January 1. You must reapply each year to keep the exemption in effect.

Certain Settings May Soon Be Exempt From Indoor Masking

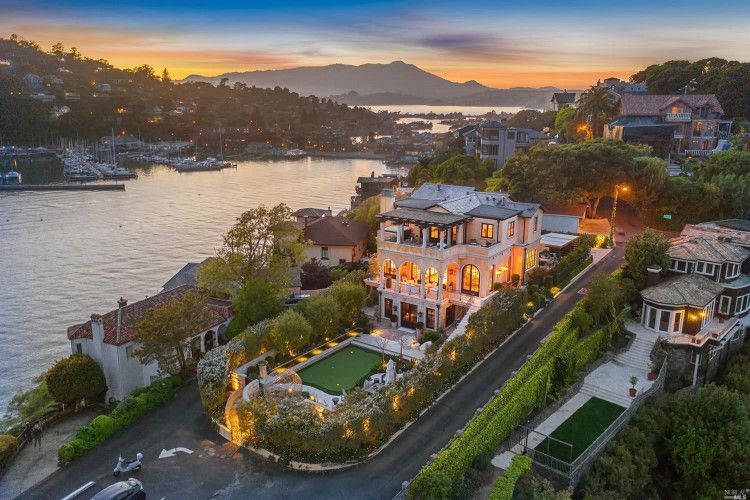

6 Marin County Properties With Staggering 25m Price Tags Have Come On The Market In The Past Few Months

Marin Wildfire Prevention Authority Measure C Myparceltax

Transfer Tax In Marin County California Who Pays What

Job Opportunities Career Opportunities At Marin County Superior Court

Marin County Real Estate Market Report September 2021 Latest News

![]()

Pandemic May Excuse Late Payment Of Due Marin Property Tax

Restrictive Covenant Resources Marin County Free Library

Marin County Real Estate Market Report June 2021 Latest News

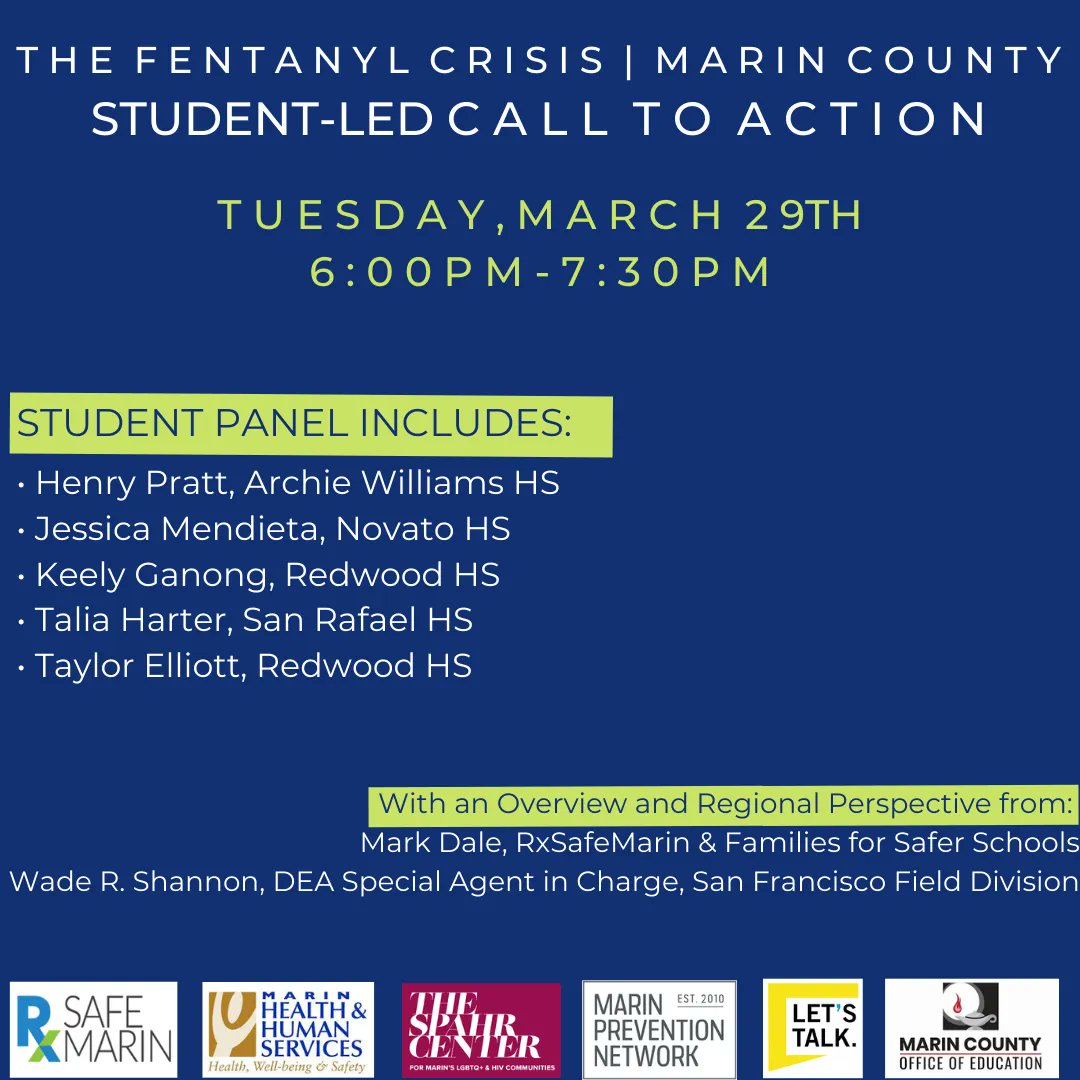

Marinhealth Humansvc Marinhhs Twitter

Marin County California Property Taxes 2022

Marinhealth Humansvc Marinhhs Twitter

Marin County Real Estate Market Report August 2021 Latest News

Marin County Real Estate Market Report May 2021 Trends Market News

Transfer Tax In Marin County California Who Pays What