child tax credit november 2021 late

Going forward its still unclear if. The deadline is 1159 pm Eastern Time on Monday November 15.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Ольга Simankova Getty ImagesiStockphoto.

. To get the full enhanced CTC which amounts to 3600 for children under 6 years old and 3000 for kids ages 6 to 17 years old single taxpayers must earn less than 75000 and joint filers must. If Married Filing Jointly If Letter 6419 Has a Different Advance Payments Total. It is key to the Bidens administrations effort to.

Most of the millions of Americans. Contact Us 617 353-0909. BBC Newsday 0000.

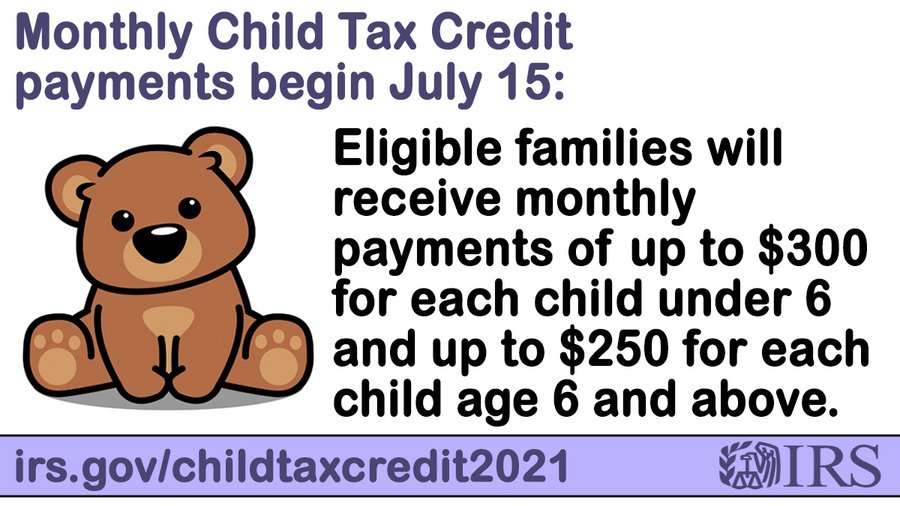

This is the second to last payment of the monthly checks as the last installment will be on December 15. Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit. Eligible families who did not receive advance payments can claim the Child Tax Credit on their 2021 federal tax return to receive missed payments and the other half of the credit.

Last updated 11242021. Get your advance payments total and number of qualifying children in your online account. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

Subsequent payment dates are. Most payments are being made by direct deposit. Unfortunately its too late to un-enroll from the September payment as the IRS deadline to opt out was on August 30.

Families signing up now will normally receive half of their total Child Tax Credit on December 15. For 2021 the credit phases out in two different steps. Normally you get the Child Tax Credit when you file your tax return youd get the 2021 credit in the spring of.

This segment aired on November 15 2021. Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income. How to Sign Up for the Last Child Tax Credit Check.

To reconcile advance payments on your 2021 return. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in 2021. What is the Child Tax Credit CTC.

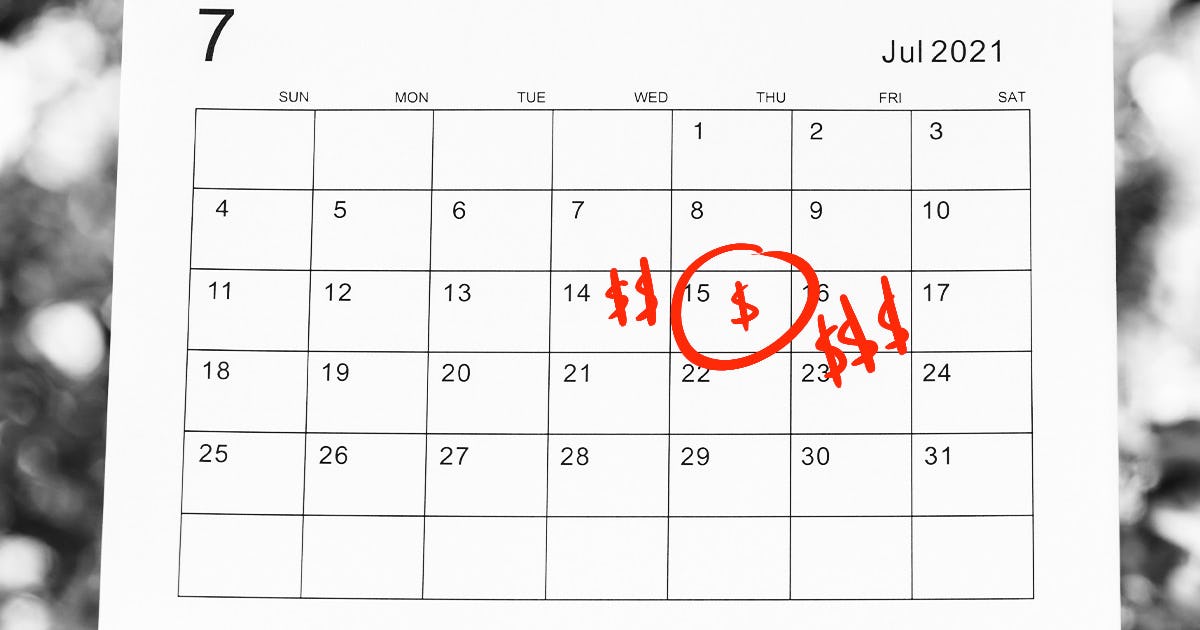

Latest child tax credit payment arrives Monday. The fifth installment of the advance portion of the Child Tax Credit CTC payment is set to hit bank accounts today November 15. PT 6 min read If you havent received your child tax credit check it could be late.

Families can choose to file either in English or Spanish. 15 deadline according to the IRS will normally receive half of their total child tax credit on Dec. Unfortunately its too late to un-enroll from the October payment as the IRS deadline to opt out was on October 4.

21 2021 1100 am. This final batch of advance monthly payments for 2021 totaling about 16 billion will reach more than 36 million families across the country. This means a payment of up to 1800 for each child 5 and.

To help families plan ahead the IRS also announced today that in late. IR-2021-211 October 29 2021 WASHINGTON On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child Tax Credit payments to update their income using the Child Tax Credit Update Portal CTC UP found exclusively on IRSgov. Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the.

If the modified AGI is above the threshold the credit begins to phase out. He advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. Right now they can only sign up online.

Heads of Jan 23 2022 The IRS started sending them out in late December 2021 continuing into January saying 2021 Total Advance Child Tax Credit AdvCTC Payments near the top and Letter 6419 on the bottom Jul 02 2021 IRS data shows just who got 400 stimulus payments. The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December. To do so quickly and securely visit IRSgovchildtaxcredit2021.

Calculation of the 2021 Child Tax Credit. Families who sign up by the Nov. You can also refer to Letter 6419.

Will receiving advance Child Tax Credit payments cause a delay in my refund when I file my 2021. However families can still opt out for the final three checks by un-enrolling. September 15 October 15 November 15 and December 15.

However people can still claim any remaining stimulus money theyre owed on their. Each qualifying household is eligible to receive up to 3600 for each child under 6. For information on how the amount of your Child Tax Credit could be reduced based on the amount of your income see Topic C.

The first half of that credit has been delivered in monthly payments of up to 300 for children under 6 and 250 for those aged 6 to 17. For those who claimed early the IRS has been sending families half of their 2021 child tax credit as monthly payments of 300 per child under six and 250 per child between the ages of six and 17. Enter your information on Schedule 8812 Form 1040.

The American Rescue Plan expanded the credit for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those ages 6. Sarah TewCNET The monthly. If Congress doesnt extend it the Child Tax Credit would revert to its pre-2021 level or 2000 for each child under the age of 17.

The Child Tax Credit CTC helps offset the costs of raising kids. Generally see Topic B. Most families will receive the full amount which is 3600 for each child under age six and 3000 for each child ages six to 17 in 2021.

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit Dates As Irs Set To Send Out New Payments

Childctc The Child Tax Credit The White House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

2021 Child Tax Credit Advance Payments Claim Advctc

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How Much Money You Ll Get When Child Tax Credit Payments Start This Week Fortune

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Deadline Missed Here S What Parents Need To Know